MPH Tokenomics

MPH token address: 0x8888801af4d980682e47f1a9036e589479e835c5

MPH Total supply

The total supply of the MPH token will be capped at 1,888,888 tokens.

To avoid a limitation on the future growth of 88mph, the keys to mint MPH tokens will not be burnt, so that after January 1, 2026 (in 4 years), MPH holders may vote to ratify a new token supply cap if desired.

How is MPH distributed?

At the time of the 88mph's governance vote for the implementation of the 8IP#6 - Implement 88mph Tokenomics 2.0 on Dec 19, 2021, the MPH total supply was roughly 417k tokens distributed to 88mph's users when they interacted with the protocol. With a cap of 1,888,888 tokens, roughly 1.4M tokens remain to be issued over the next 4 years.

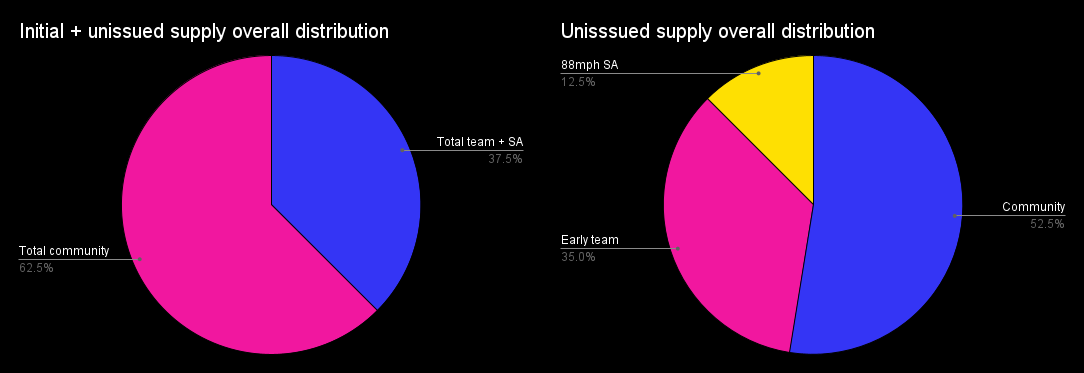

The total supply will be distributed as such:

62.5% to community

37.5% to team, advisors, and future employees with 4 years vesting.

The unissued supply of 1.4m will be distributed as such:

52.5% to community

35% to early team and advisors

12.5% to 88mph SA

We think that this total supply distribution is in line with the industry standards (for eg. Curve.fi or Frax.finance distribution)

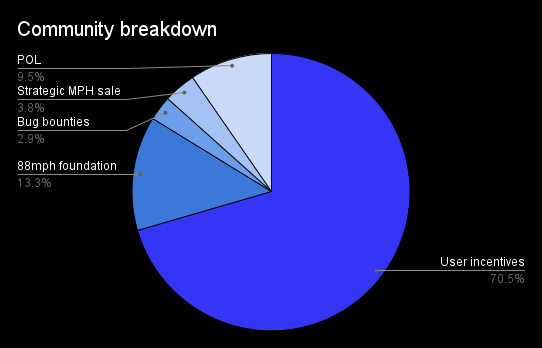

Community breakdown (52.5% of unissued MPH)

70.5% will be used for incentives to 88mph users over a 4-year distribution schedule:

46.2% will be used for incentives in 2022, which will be immediately minted after the passage of this proposal to prepare for distribution.

30.8% will be used for incentives in 2023

15.4% will be used for incentives in 2024

7.7% will be used for incentives in 2025

13.3% is being allocated to the 88mph foundation under creation in Geneva that is subject to a 10-year unlocking schedule. The 88mph foundation is a way to steward the protocol into the future and distribute grants to developers and contributors. The foundation aims to progressively decentralize how the governance treasury resources are allocated and work with 88mph Council to make decisions in the best interest of the protocol ecosystem.

9.5% will be immediately minted and unlocked to acquire protocol-owned liquidity via Olympus Pro or similar.

2.9% will be immediately minted and unlocked to support a bug bounty program denominated in MPH.

3.8% will be immediately minted and sold to strategic community members by the foundation to have operational funds at launch. This strategic allocation will be locked up for 1 year.

Early team and advisors (35% of unissued MPH)

The early team consisted of 2 founders, and multiple contractors, and advisors. Founders, contractors, and advisors will be on standard 4-year vesting schedules.

The early team is a group of passionate developers, product builders, and business leaders, dedicated to the Ethereum Ecosystem. This team delivered many innovative products since 2017 through various market conditions. They’ve created significant value for 88mph and proven their talent, commitment, work ethic, and execution ability.

88mph SA (12.5% of unissued MPH)

88mph is the commercial entity developing 88mph protocol since January 15, 2021. This Swiss entity will continue to grow as the standalone organization contributing to The 88mph ecosystem. The organization has no external shareholders and will be under a 4-year vesting schedule.

64.3% will be used to fund future developments of the protocol and its associated costs (contractors, audits, taxes, etc).

28.6% will be allocated to future employees with vesting.

7.1% will be immediately minted and unlocked.

If the governance decides to renegotiate the MPH supply cap after 4 years, the schedule for the increased issuance will be decided by governance at that point in time.

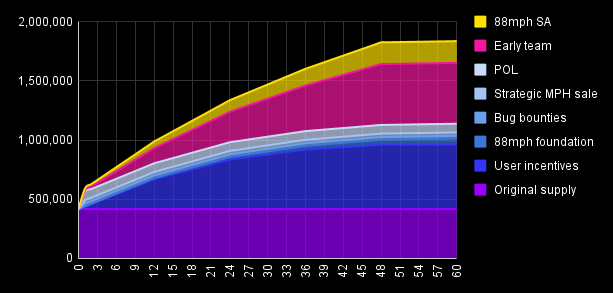

5-year MPH circulation schedule by buckets (cumulative)

Gauge-based incentives & veMPH

Around June 2022, 88mph will adopt a new system for allocating user incentives, adapted from gauges pioneered by Curve Finance and Frax Finance. MPH holders will be able to lock up their bnMPH tokens for up to 4 years in exchange for veMPH, which provides the right to vote on gauge weights, earn protocol revenue, and vote in governance proposals to control fees and protocol parameters, new asset listing, etc.

Each 88mph pool will be regularly allocated MPH incentives based on gauge weights. 88mph depositors will earn these incentives automatically when they deposit and may get diluted when more deposits are made similar to Synthetix-style staking pools. Deposits made before the passage of this proposal will still get their promised MPH incentives.

MPH incentives to yield token buyers will be deprecated. Existing yield token buyers will still get their promised MPH incentives.

xMPH will be gradually phased out, in favor of veMPH. To make the transition less impactful on existing xMPH holders, staking rewards will be initially distributed to both xMPH holders and veMPH holders, and move towards distributing all staking rewards to veMPH holders in the following fashion:

In Q1/Q2 2022, 50% of rewards will be distributed to veMPH holders, and 50% to xMPH holders.

After Q2 2022, 100% of rewards will be distributed to veMPH holders.

Notes: the gauges & veMPH will live on mainnet, and the farming pools on other chains will receive tokens directly from the mainnet gauges.

Fixed yield rate MPH rewards

Currently, when a user deposits assets to earn a fixed yield rate via 88mph, they will receive newly-minted MPH tokens equal to

which will be continuously vested over the deposit duration. The vesting stream is represented using NFTs (ERC-721).

Example

Suppose that Vitalik deposits 100 DAI for 180 days, and the asset's issuance multiplier for DAI deposits is 0.01 MPH / (DAI x day). Then the total MPH reward will be 100 DAI x 180 days x 0.01 = 180 MPH.

This is assuming that the deposit is not modified. If the deposit is withdrawn or topped up, the reward for the remaining deposit period will be determined using the same formula with the updated values. For instance, if after 60 days Vitalik withdraws 50 DAI, he would have earned 100 DAI x 60 days x 0.01= 60 MPH so far, and for the remaining period he would earn 50 DAI x 120 days x 0.01 = 60 MPH.

Yield token MPH rewards

MPH rewards for yield tokens has been paused.

Issuance rate multiplier

The issuance multiplier of each pool is configured by the governance multisig.

For issuance rate updates, we use the governance multisig directly as the contract owner. The protocol's parameters will be handed over to the community token holders when the governance will be more mature.

How 88mph ensures the long term sustainability of the protocol

The fixed-rate yield pools and yield tokens generate an allocation of newly minted MPH for the 88mph developer fund and governance treasury from the MPH minter contract (1O% of all MPH reward distributed to users).

Developer fund

Whenever MPH is minted by user activities, an additional 10% of the minted amount is minted and sent to the developer fund. These MPH tokens will be used to pay for future development & maintenance of the protocol.

Development funds controlled by 88mph SA: 0xfecBad5D60725EB6fd10f8936e02fa203fd27E4b

Governance treasury

Whenever MPH is minted by user activities, an additional 10% of the minted amount is minted and sent to the governance treasury. These MPH tokens will be used according to the governance proposals approved by the community on the Snapshot page and the 88mph foundation.

Governance treasury controlled by the 88mph Foundation: 0x56f34826Cc63151f74FA8f701E4f73C5EAae52AD

Last updated